Economic Capsule: May 2023

Economy

73 week ago — 19 min read

Presenting updates for May 2023 in the Banking & Finance, Business, Development and Global Economic sectors.

Banking & Finance

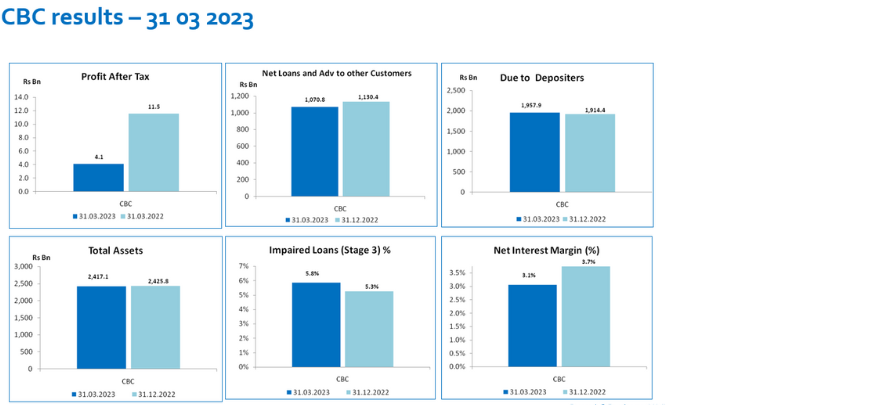

ComBank adjudged the ‘Best Bank in Sri Lanka’ bby Global Finance for 21st time

The Commercial Bank of Ceylon has been recognized as Sri Lanka's Best Bank once again by the US-based Global Finance magazine, at its 30th annual awards ceremony for the World's Best Banks 2023, reaffirming the Bank's reputation as the top performer in the country's financial industry.

This is the 21st occasion that Commercial Bank has won this title. Global Finance considered factors that ranged from the quantitative objective to the informed subjective.

Objective criteria included: growth in assets, profitability, geographic reach, strategic relationships, new business development and innovation in products. Subjective criteria included the opinions of equity analysts, credit rating analysts, banking consultants and others involved in the industry. Award winners were selected by the editors of Global Finance after extensive consultations with corporate financial executives, bankers and banking consultants, and analysts throughout the world.

ComBank is highest ranked bank in BT Top 40 for 14th consecutive year

The Commercial Bank of Ceylon led Sri Lanka’s banking sector when it received the Business Today Top 40 award.

This represents the 14th consecutive year that Commercial Bank became the highest-ranked bank and one of the five best-performing companies in Sri Lanka overall, in the Business Today ranking. The ranking, based on the 2021-2022 results of companies, recognised the top corporate performers that reported positive financial growth amidst the turbulent situation of the country.

Business Today said an analysis of the diverse portfolios of the ranked companies provides a broader picture of the profits and the risks undertaken by these corporates as they worked with resilience, passion, and dedication while gracefully embracing the challenges.

Economy, Business & Development News

Key points of recent IMF visit

“Following strong policy efforts, the macroeconomic situation in Sri Lanka is showing tentative signs of improvement, with inflation moderating, the exchange rate stabilizing, and the Central Bank rebuilding reserves buffers.

However, the overall macroeconomic and policy environment remains challenging.

“Performance under the IMF program will be formally assessed in the context of the first review of the Extended Fund Facility arrangement, which is expected to be undertaken in September 2023

Discussions were made on additional fiscal efforts that will be critical to ensure successful revenue mobilization.

IMF is observing the debt restructuring progress and achieving timely restructuring agreements with creditors in line with the program targets by the time of the first review will be essential to restoring debt sustainability.

Government should keep up the reform momentum and ensuring timely implementation of program commitments, including to ensure CBSL independence, improve governance, and protect the vulnerable are key for Sri Lanka to emerge from the crisis.”

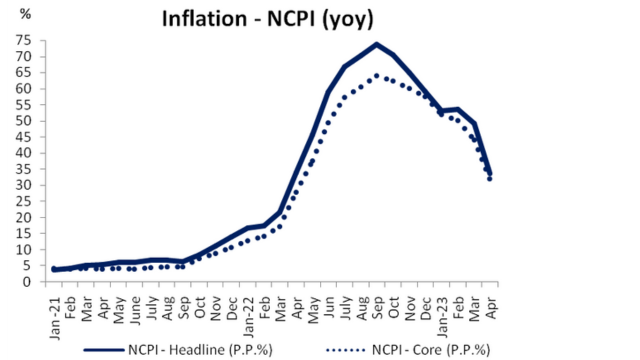

NCPI – April 2023

April national inflation is also the lowest in 14 months when the consumer prices rose at 21.5% in March, last year.

*Core inflation excludes volatile food, energy and transport prices

Foreign investments in government securities

Foreign holdings of T bills and T bonds rose to Rs 150.52bn during the week ended 18 May 2023.

Sri Lanka securing an IMF program and talks about domestic and foreign debt restructuring have contributed to increase foreign investor appetite towards government securities.

However, this figure is far less than 2017 levels. Foreigners held government securities worth Rs324.32bn as at end December 2017.

Increased foreign inflows through the bond market is one reason behind the rupee’s recent resurgence.

(As of 24 May, the USD/LKR middle rate published by CBSL was 304.61)

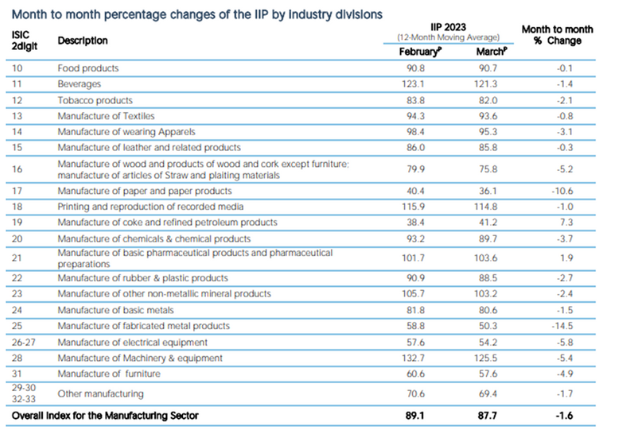

Sri Lanka’s industrial production slips on softening global market conditions

Sri Lanka’s industrial production slipped in March from February as most of the manufacturing segments weakened on the back of softening global demand and also precarious local market conditions.

The Index of Industrial Production (IIP) is an abstract number, the magnitude of which represents the status of production in the industrial sector for a given period of time.

Its main purpose is to provide a measure of the short-term changes in the volume of industrial production from the manufacturing sector in the country.

The IIP provides Information to gauge industrial performance and to forecast the future economic performance.

It can be used to identify the turning points in economic development at an early stage. The major advantage of the production index compared to other indicators is the combination of fast availability and detailed breakdown of activities.

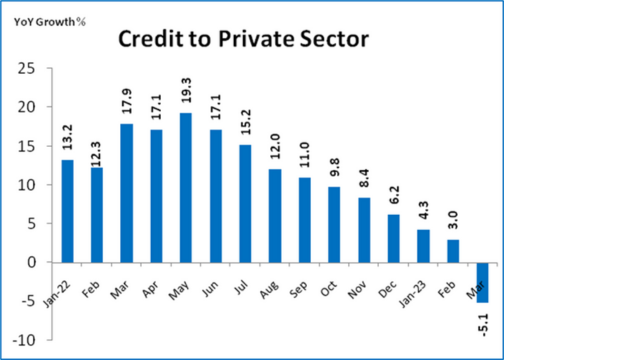

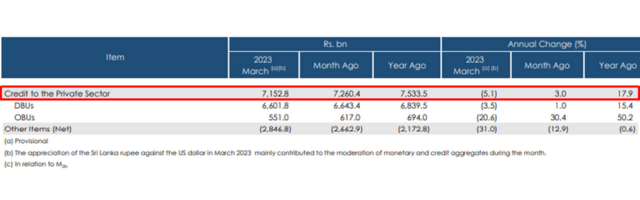

Slump in credit to private sector

The months-long descent in credit to the private sector turned more pronounced in March as such credit reported a net de-growth of Rs.107.6bn, nearly doubling from the Rs.57.6bn contraction in February 2023. (5.1% YoY decline in March 2023)

The larger decline in net credit to the private sector demonstrates that the economy was still in decline although it might have turned a corner and found some footing with the improvement in the foreign currency conditions in the country and the deceleration in the consumer prices.

China’s Sinopec seals deal to enter Sri Lanka’s retail fuel market

In a significant move to address Sri Lanka’s fuel supply challenges, a contract agreement was signed with Sinopec, a leading international petroleum company. The agreement, signed on 22 May, marks a crucial step in ensuring a steady and uninterrupted fuel supply for the nation.

The license grants Sinopec to import, store and distribute fuel in Sri Lanka for a 20-year period while bringing in competition to the country’s duopoly retail fuel market dominated by state-owned Ceylon Petroleum Corporation (CPC) and Lanka Indian Oil Company (LIOC).

A key requirement for new retail suppliers entering the market is their ability to secure forex requirements, without depending on the domestic banking sector. “It was mandated that these companies source their own funds for fuel procurement through foreign sources, at least during the initial one-year period of operation” PMD report said.

Sri Lanka promises EU to present plan to lift import restrictions by June

Sri Lanka has promised the European Union (EU), the country’s second largest trading partner, to present a plan by June to lift the import restrictions that came into place in 2020 as a measure to hold on to the fast-depleting foreign exchange reserves.

This was conveyed during the 25th session of Sri Lanka - EU Joint Commission that was held virtually on April 25, 2023.

Sri Lanka expressed its intention towards a gradual phasing out of the restrictions, factoring in the current economic conditions.

News Snippets

Confectionery industry cuts retail prices as consumption drops

The local confectionery industry is witnessing a consumption drop of over 25%, due to the escalation of the prices of all product ranges and to remedy the situation, a decision has been taken by Lanka Confectionery Manufacturers Association (LCMA) to reduce the prices.

Net foreign assets (NFA) of banking system

Net foreign assets of banking sector, which turned negative amid the economic crisis has returned to positive territory as banks have improved their foreign currency liquidity. NFAs which moved to positive territory in February to around Rs 61bn has further improved to Rs 80.3bn in March 2023.

Galadari Hotel to proceed with proposed refurbishment after 4-year hiatus

Galadari Hotels (Lanka) PLC has decided to proceed with the proposed refurbishment of the 450-room hotel after a 4-year hiatus, of which details are yet to be finalised.

EU backing for Sri Lanka on climate change adaptation

The European Union (EU) has expressed its willingness to extend support to Sri Lanka as it adapts to the impacts of climate change. The EU has said it is committed to working with Sri Lanka to help the country build a more resilient and sustainable future.

Manufacturing activities dropped in April

Following the seasonal pattern, Sri Lanka’s manufacturing PMI decreased to 34.7 in April 2023, indicating a month-on-month contraction in manufacturing activities. Services sector PMI remained slightly below the neutral threshold, recording an index value of 49.6 in April 2023.

Global Update

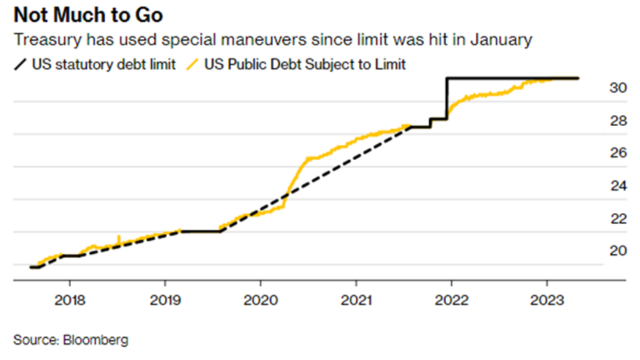

US “Debt ceiling limit” Saga

“Debt ceiling limit” in simple terms is a lid on government spending/borrowing. For USA, this lid on US government borrowing affects only the ability to pay existing bills, not to approve more spending.

*US Congress (legislative system) has two chambers

– House is the lower chamber

** – Senate is the higher chamber

Any law or bill will be passed if they receive majority vote of both House and the Senate.

Presently Republicans have the majority of the House and Democrats have the majority of Senate. Hence implementation of laws, bills has become harder due to their differences.

China overtakes Japan as world's top car exporter

China says it has become the world's biggest exporter of cars after overtaking Japan in the first three months of the year.

Officials figures released in the last week show China exported 1.07mn vehicles in the period, up 58% compared to the first quarter of 2022.

At the same time Japan's vehicle exports stood at 954,185, after edging up 6% from a year earlier. China's exports were boosted by demand for electric cars and sales to Russia. Last year, China overtook Germany to become the world's second largest car exporter.

According to China's General Administration of Customs, China exported 3.2mn vehicles in 2022, compared to Germany's 2.6mn vehicle exports. The shift away from fossil fuels has helped fuel the rise of China's motor industry.

“Britain would not enter into a recession this year” - IMF

The IMF said that Britain would not enter into a recession this year, revising earlier predictions that its economy would shrink by 0.3% in 2023.

It now expects GDP to grow by 0.4%. The fund said that resilient demand had bolstered Britain’s ailing economy, but warned that the outlook for growth “remains subdued” and that inflation is still “stubbornly high”.

The U.K. economy grew by 0.1% in the first quarter 2023, following an unexpected contraction in March, official figures showed.

The construction sector expanded by 0.7%, while manufacturing performance went up by 0.5% in the first quarter, with 0.1% growth logged in services and production.

After Iran Deals, Indian Lender Spurs Rupee Trade With Russia

A state-run bank India used to skirt sanctions is spurring trade with Russia by using rupees as payment and expects to see more deals as Moscow gets increasingly locked out of the global financial system.

UCO Bank, which handled India’s purchases of Iranian crude and managed billions of dollars of frozen payments, is now a key bank facilitating trade with sanctions-hit Russia in rupees.

UCO Bank, among the smallest of the state-owned banks by market capitalization, facilitates the transactions through a special rupee account with Gazprombank, which acts as an agent to execute withdrawals and deposits for Russian businesses. Gazprombank is one of the main channels used for paying for oil and gas.

News Snippets

IMF raises 2023 Asia-Pacific growth forecast

The International Monetary Fund raised its growth forecast for Asia-Pacific (4.6%), saying the region’s growth will be primarily driven by China’s recovery and “resilient” growth in India. This comes as the rest of the world braces for slower growth from tightened monetary policy and Russia’s invasion of Ukraine.

Natural gas prices in EU drop

The price of natural gas in Europe fell to its lowest level since July 2021. Alternatives to Russian energy and a mild winter that has left gas stocks in good shape were factors in the benchmark Dutch ttf contract (Dutch ttf is a virtual trading hub for gas in the Netherlands and is the primary gas pricing hub for the European gas market) falling to just over Euro 35 (USD 38) a megawatt hour (mwh).

Last August the price peaked at more than Euro 300 a mwh as Russia squeezed its supplies.

Global Central Bank policy decisions

The Federal Reserve raised interest rates by a quarter point (0.25%) on 03 May, the tenth rate hike since the central bank started its battle against inflation last March. The Federal Reserve’s interest-rate increases have helped consumer-price growth to slow since its peak in June (Annual inflation dropped to 4.9% in April 2023). Markets are betting that the Fed will soon pause the run of rate rises, though the labour market is still running hot. Employers created 253,000 jobs in April 2023, well above estimates.

The Bank of England raised its benchmark interest rate for the twelfth consecutive time on 11 May, lifting it by 0.25% to 4.5%, its highest level since 2008. Annual inflation in Britain has remained stubbornly high, well above inflation in America and the euro area. The bank said that further rate rises were on the cards, if inflationary pressures persist

European Central Bank too increased its policy rates by a further 0.25% on 04 May to 3.75%.

The Reserve Bank of Australia surprised markets when it raised its rate by 0.25%, to 3.85%. The bank had left the rate on hold in April, suggesting that a rapid run of increases was over.

Emerging from the economic crisis

“Sri Lanka has for a long-time dreamt of joining Global Value Chains (GVCs) with little success. Now GVCs are coming to India and as a result right to Sri Lanka’s doorstep. This offers Sri Lanka a second chance to make its long-standing dream a reality. By focusing on supply chain integration and resilience, ETCA like agreements can help Sri Lanka to put itself on the map of GVCs that is being redrawn”.

- Subhashini Abeysinghe and Mathisha Arangala from Verite Research.

The views expressed in Economic Capsule are not necessarily those of the Management of Commercial Bank of Ceylon PLC.

The information contained in this presentation has been drawn from sources that we believe to be reliable. However, while we have taken reasonable care to maintain accuracy/completeness of the information, it should be noted that Commercial Bank of Ceylon PLC and/or its employees should not be held responsible, for providing the information or for losses or damages, financial or otherwise, suffered in consequence of using such information for whatever purpose.

View Commercial Bank 's profile

SME Inspirations

Other articles written by Commercial Bank LEAP Team

Economic Overview: January 2024

39 week ago

Economic Overview: December 2023

44 week ago

Most read this week

Trending

Comments

Please login or Register to join the discussion