Economic Overview: December 2023

Economy

20 week ago — 12 min read

Macroeconomic Overview

- Sri Lanka requires a sustained period of credit expansion to ensure continuity of the economic recovery initiated in 3Q, 2023.

- The rise in tourism has led to a revival in the accommodation, food and beverage sectors.

A welcome positive growth rate in 3Q, 2023

The GDP growth rate for the third quarter of year 2023 has recorded a positive growth rate of 1.6 % (yoy) after almost two years of recession. Some key factors that supported this achievement are examined in the following sections.

Credit expansion

The achievement of a positive growth rate in 3Q, 2023 is attributed, among other factors, to the availability of credit at relatively lower interest rates, starting from the second half of 2023, as per the Department of Census and Statistics (DCS).

Accordingly, credit to the private sector expanded for the fifth consecutive month in October, 2023 in line with the expectations of the Central Bank, which had slashed the policy rates significantly to spur growth. The month-on month increase in credit to the private sector recorded Rs.75.5 Bn, Rs.13.2 Bn and Rs.5.6 Bn, respectively in June, July and August, and recorded Rs. 69.7 Bn in September, 2023, followed by an increase of Rs. 37.9 Bn in October, 2023,

The interest rates, which recorded sharp increases for the majority of 2022, displayed some stabilization in the first half of 2023. Thereafter interest rates reduced significantly from the second half of 2023 amid the aggressive cuts in policy rates by the Central Bank and also successful conclusion of the domestic debt optimization program. The Central Bank has reduced the policy rates by 650 basis points cumulatively since June, 2023. Further, the Central Bank also adopted a more activist role by issuing guidance to banks on the extent to which interest rates should be reduced, and by lowering the caps on specific lending products, including gold-backed loans, credit cards and pre-arranged overdrafts.

Since of late the banks have been engaged in capital raising activities by way of debt issuances, to boost their capital, with a view to increasing their lending capacity. The pace of private sector credit is expected to accelerate in the period ahead with further moderation in lending rates, thereby boosting domestic economic activity. Sri Lanka requires a sustained period of credit expansion to ensure continuity of the economic recovery initiated in 3Q, 2023.

Achieving some normalcy in the foreign exchange markets

The 3Q, GDP growth rate which recorded a positive 1.6% was a clear indication of Sri Lanka’s recovery from the worst shortage in foreign currency that the country has experienced since gaining independence, which sent shock waves through the economy as prices and the exchange rate increased sharply while creating prolonged shortages of commodities. (DCS)

Sri Lanka suspended most of its foreign currency loan repayments in April, 2022 until a deal with the country’s foreign creditors to restructure the debt is finalized. This helped to restore some normalcy in the foreign exchange markets, enabling the flow of imports, which are required to power the industries, thereby enabling them to return to their normal production schedules, although at a lesser scale as demand still remains subpar. Additionally, the 10.7% appreciation (year-to-date 19th November, 2023) in the exchange rate has helped to bring down the input cost of the produce. (DCS)

Rebound in remittances and tourism

Remittances and earnings from tourism have made significant gains in the first 10 months of 2023. The disbursement of funds in relation to two tranches of the IMF-EFF program, together with other inflows that the program has helped to unlock, have led to an improvement in business sentiments and aided the economic recovery.

Additionally, the rapid recovery in the tourism industry has helped to reactivate many other economic activities, which stood virtually stagnant from 2020 onwards, thereby contributing to increase economic output. In particular, the rise in tourism has led to a revival in the accommodation, food and beverage sectors. (DCS)

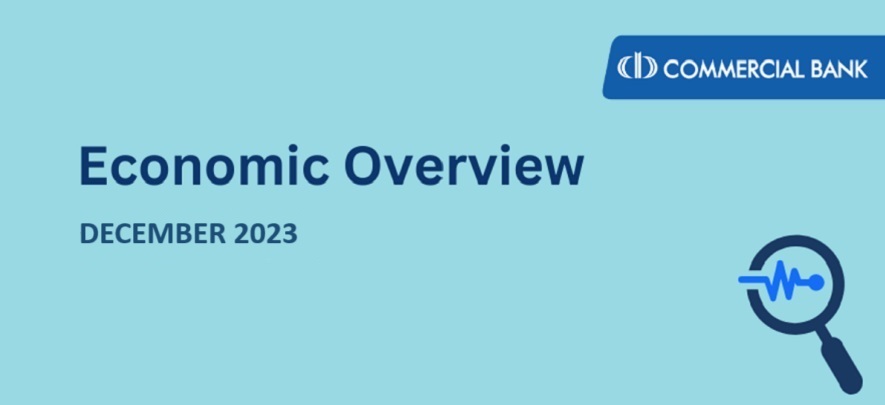

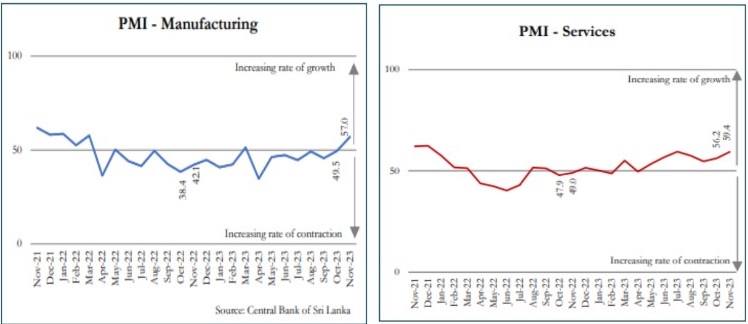

Both manufacturing and services in expansion mode

The manufacturing and services sectors were in expansion mode (above the neutral level of 50) in November, 2023 as per the Purchasing Managers Index (PMI) compiled by the Central Bank.

PMI - Manufacturing

The Manufacturing PMI increased to 57 on a month-on-month basis in November 2023, driven by the seasonal factors. The index exceeded the neutral threshold (50) for the first time since March 2023, with a positive contribution from all the sub-indices, according to CBSL.

The increases in new orders were largely driven by the ‘manufacture of food & beverages’ and ‘textiles & apparel’ sectors. Moreover, the increase in production was largely due to the manufacture of food & beverages, owing to the seasonal demand.

The overall expectation for the manufacturing activities remained positive for the next three months, mainly due to the gradual recovery in economic activities. However, the firms are concerned about the tax revisions, which will be effective from January 2024.

PMI – Services

The Services sector PMI recorded an index value of 59.4 in November 2023, compared to an index value of 56.2 in October 2023, indicating an accelerated expansion in the services activities. This was led by the increases observed in new businesses, business activities, employment and expectations for activity.

Business activities in relation to the services sector continued to expand in November 2023 in line with the positive developments observed in most of the sub-sectors. Accordingly, significant improvements were observed in business activities related to other personal activities and ‘accommodation, food and beverage’ sub-sectors driven by the sharp increase in tourist arrivals. Financial services improved further in line with the increase in credit demand following the recent reductions in policy rates and their impact on market interest rates.

The wholesale and retail trade sub-sector also continued to grow amid the festive season, supported by the seasonal discounts offered.

According to CBSL, expectations for the next three months with regard to business activities in relation to services, continued to increase in November 2023 due to festive and tourist seasons. However, some respondents have expressed their concerns regarding the amendments to Value Added Tax w.e.f. 1 January 2024.

Outlook for the future

The rate of inflation is expected to remain at the target range of 4-6% of the Central Bank in the next couple of months, in view of the normalization of monetary conditions, enhancements in supply conditions, and the impact of growth-promoting structural reforms. However, the key risks to this view stem from uncertainties related to the price of oil and other commodities, climate related risks, possibility of greater than expected depreciation of the rupee in view of the ongoing relaxation of import restrictions, and impact of VAT increase and removal of VAT exemptions on a number of previously exempted goods.

Sri Lanka’s construction sector, which accounts for 6.3% of the economy and is known for generating significant employment, recorded a contraction of 5.5% in 3Q, 2023 compared to the corresponding quarter in 2022. However, the sector decline has slowed significantly from the 23.1% (YoY) contraction recorded in 2Q, 2023, thereby reflecting that the sector is nearing the end of its declining trend which lasted for two years. Further, there are emerging signs that projects, particularly those funded by the multilateral agencies and the government, are resuming, indicating the potential for a rebound in the sector.

Interest Rates & Exchange Rate

At the T-bill auction held on 20th December, 2023 yield of 91 day t-bill decreased to 14.57% from 14.59% a week ago (-2bps) while yield of 182 day t-bill dropped to 14.24% from 14.29% a week ago (-5bps). The 364 day t-bill yield marginally increased to 12.93% from 12.83% (10bps). Meanwhile Rs 172.5bn worth bills were offered at the auction and Rs 156.16bn worth bills were sold.

CBSL purchased USD 117mn worth dollars from commercial banks on a net basis during November 2023.

The Central Bank middle rate recorded Rs.326.80 per US dollar as of 20 December, 2023.

Global Outlook

- The world economy is on the brink of a second cold war that could “annihilate” progress made since the collapse of the Soviet Union, a senior International Monetary Fund official has warned. Gita Gopinath, the IMF’s first deputy managing director, said the accelerating fragmentation of the world economy into regional power blocs – centred around the US and China – risked wiping out trillions of dollars in global output.

- The Federal Reserve left its key interest rate on hold at a range of between 5.25% and 5.5%, but it also published projections that suggested it would cut rates three times in 2024. The Fed’s decision came after data for November showed that America’s annual inflation rate had slowed only slightly to 3.1%, and the core rate, which excludes food and energy, had remained at 4%.

- The European Central Bank and Bank of England followed suit and kept their rates on hold. The ECB gave little away about when it might reduce rates, though it did lower its inflation forecasts. The British central bank scotched hopes that it would loosen policy soon, confirming that rates needed to be kept elevated for an “extended period of time” to curb inflation.

- Britain’s two-year cost of living crisis eased last month as cheaper petrol and less expensive food helped send the annual inflation rate sharply lower to 3.9% – its second big monthly fall in succession.

- Oil rose slightly on 20 December as investors kept an eye on the situation in the Red Sea after recent attacks by Iran-aligned Yemeni Houthi militants. USA Launched a task force to safeguard Red Sea commerce as attacks by the Yemeni militants forced major shipping companies to reroute, stoking fears of sustained disruptions to global trade.

- China reported its industrial output expanded at the fastest pace since February 2022 in November, though retail sales growth missed expectations, pointing to a patchy recovery in the world’s second largest economy. China’s industrial output grew 6.6% in November from a year earlier, according to the country’s National Bureau of Statistics.

Dr. Shanthikumar Fernando | Research & Development Unit | shanthikumar_fernando@combank.net

Disclaimer: This document has been issued for the information of the customers of Commercial Bank of Ceylon PLC only. The Bank and its employees do not accept any responsibility for the accuracy or completeness of the contents and any losses arising from any use of this material.

View Commercial Bank 's profile

Other articles written by Commercial Bank LEAP Team

Economic Overview: January 2024

14 week ago

Most read this week

Comments

Please login or Register to join the discussion