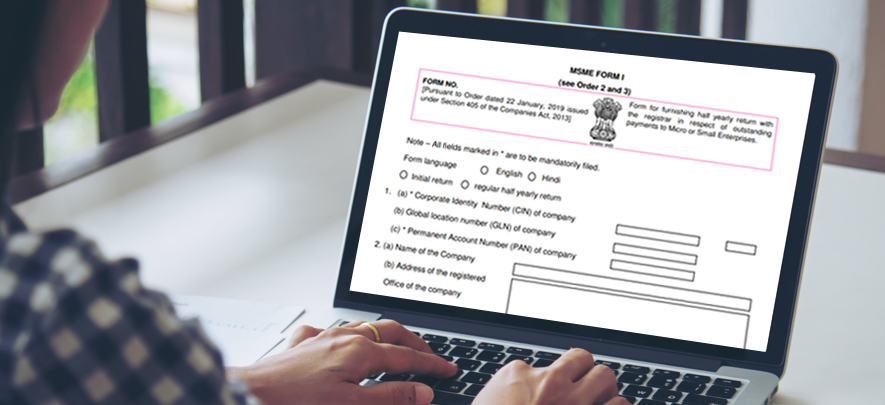

All about Form MSME-1

சட்ட மற்றும் இணங்குதல்

297 வாரத்திற்கு முன்பு — 3 நிமிடம் படிக்க

Background: The Ministry of Corporate Affairs (MCA) recently passed 'Specified Companies (Furnishing of information about payment to micro and small enterprise suppliers) Order 2019'. As per the order every specified company will have to file MSME-1 Form details of all outstanding dues to micro or small enterprises suppliers existing on the date of notification of this order, within thirty days from the date of publication of this notification.

Here is everything you need to know about the MSME-1 Form.

1. Every company that has purchased and accepted goods or services from micro and small enterprise/s and for which payment is yet to be made to such enterprise/s after 45 days from the date of acceptance of goods/ services needs to file Form MSME-1.

2. Micro enterprises include enterprises having an investment in plant and machinery not exceeding INR 25 lakhs in case of manufacturing and INR 10 lakhs in case of service sector.

3. Small enterprises include enterprises having an investment in plant and machinery worth more than INR 25 lakhs but does not exceed INR 5 crores in case of manufacturing and more than INR 10 lakhs but does not exceed INR 2 crores in case of service sector.

4. Companies are not required to file any details regarding medium enterprises, i.e., even if there is any delay from company’s part to pay beyond 45 days, as it will not qualify to be reported in this form.

5. Every company needs to identify enterprises (from whom purchases are made) registered with MSME and find out the enterprises against whom payment is due beyond 45 days. These enterprises need to be reported along with their Permanent Account Number (PAN), date from which amount is due and the reasons for non-payment.

6. This form needs to be filed twice a year, i.e., every six months, one on 31 October and other on 30 April.

7. Since this form is to be filed for the first time therefore, one time return needs to be filed within 30 days of the form going live. This means, 30 days shall be reckoned from the date the said e-form is deployed on MCA 21 portal as per General Circular No. 01/2019 dated 21 February, 2019 issued by MCA.

Penalty for non-filing of form: For a company it is up to INR 25,000 and on every Director, CFO (Chief Financial Officer) and CS (Company Secretary) fine not less than INR 25,000 but up to INR 3 lakhs or imprisonment up to six months.

To explore business opportunities, link with me by clicking on the 'Invite' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

பதிவிட்டவர்

Mohit MundhraWe are providing Taxation, Accounting, Auditing & Assurance and Consultancy services. We believe in understanding and evaluating Client’s business and needs and...

இந்த கட்டுரையில் குறிப்பிட்டுள்ள SME களுடன் பிணையம்

Mohit இன் சுயவிவரத்தை காண்க

Mohit Mundhra எழுதப்பட்ட பிற கட்டுரைகள்

Presumptive Taxation Scheme under section 44AD of Income Tax Act: Who should...

296 வாரத்திற்கு முன்பு

இந்த வாரம் அதிகம் படித்தது

டிரெண்டிங்

Step by Step Process of Creating a Digital Catalogue for Your Business

Ecommerce 17 வாரத்திற்கு முன்பு

Get more sales leads with an online business profile

GlobalLinker Assist 133 வாரத்திற்கு முன்பு

Declutter Your Business the Marie Kondo Way

Health & Lifestyle 29 வாரத்திற்கு முன்பு

கருத்துகள் (4)

தயவு செய்து உள்நுழைய அல்லது பதிவு விவாதத்தில் சேர