Benefits of registration under ‘Startup India’: Financial, income tax & more

නෛතික සහ අනුකූලතාව

සතියකට පෙර 292 — අවම 4 කියවීම

Background: The Startup India initiative was launched in the year 2016 to support the growing number of startups in India, which is estimated to be around 50,000 currently. The government recognises that in order to contribute effectively towards the economy, these startups need the proper resources to grow. From financial benefits, to registration and income tax benefits, the Startup India programme covers various aspects fundamental to the growth of a company. To understand the benefits of registration under Startup India, read this article by Navneet Dhiman.

‘Startup’ is a term used to define companies that are just getting off the ground and have a very high growth potential. These companies are initially supported by their entrepreneurial founders with an aim to develop a product which they believe can have a high demand in the market.

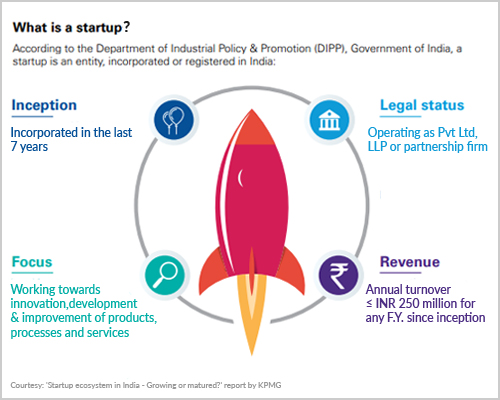

The Department of Industrial Policy and Promotion (DIPP) defines startup as a term which can be used for companies:

- That have not completed a period of seven years from its date of registration.

- Have an annual turnover not exceeding INR 25 cr.

- Is working towards innovation, development or improvement of products and services.

- Is a legal entity - operating as a Private Limited, Limited Liability Partnership (LLP) or Partnership firm

There are a lot of benefits for startups getting recognition under the Startup India programme:

1. Financial benefits

Under financial benefits, whenever a startup applies for a patent, the government will provide 80% rebate on patent costs and 50% rebate in filling trademark in case of private limited, LLP and Partnership companies. The government will also pay the fees of the facilitator and help startups obtain their patent. This way the patent registration and protection of Intellectual Property Rights (IPR) will become much easier.

2. Registration benefits

The government has launched a mobile app on 1 April 2016 which allows companies to register in a day. In addition to that, a single point of contact for queries has also been set up to tackle problems real time. A single window clearance for all clearances, approvals, and registrations, have been set up which will make the process easier for all.

3. Income Tax benefits

Startups are exempted from paying Income Tax for the first three years from the date of registration. A startup however needs to obtain a certificate from the Inter- Ministerial Board. A startup can also avail tax benefits on capital gains.

4. Other special benefits:

- Self-certification under section 9 of environmental and labour laws.

- Closure and winding up of company within 90 days under insolvency and bankruptcy code 2016.

- Fund of INR 10,000 cr through Alternative Investment Funds and INR 2,000 cr guarantee funds from National Credit Guarantee Trust Company/Small Industries Development Bank of India (SIDBI) over 4 years.

- No inspection will be for the first three years regarding labor laws.

- Environment law compliance is required only post self-certification.

Interested in reading more articles on startups? Check out our other articles here:

How to form your own startup: A legal perspective

Startup founders now need pictures to prove their business existence

Get investment firms interested in your startup

Image courtesy: www.pixabay.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

විසින් පළ කරන ලදී

CS Navneet DhimanHis Passion has been over the years to help inject techno-legal innovation and compliance strategy into Mylex Infotech Pvt Ltd. With the expertise in the compliance and legal...

CS Navneet ගේ පැතිකඩ බලන්න

SME අභිප්රෙරකයන්

CS Navneet Dhiman විසින් ලියන ලද අනෙකුත් ලිපි

Import Export Code (IEC): Benefits and how to obtain it

සතියකට පෙර 229

NITI Aayog: Definition, eligibility and registration process

සතියකට පෙර 275

Barcodes: Advantages and required application documents

සතියකට පෙර 280

මේ සතියේ වැඩිපුරම කියෙව්වේ

ප්රවණතා

අදහස්

කරුණාකර ඇතුල් වන්න හෝ ලියාපදිංචි කරන්න සාකච්ඡාවට එක්වීමට