Economic Overview: September 2023

ආර්ථිකය

සතියකට පෙර 62 — අවම 10 කියවීම

Macroeconomic Overview

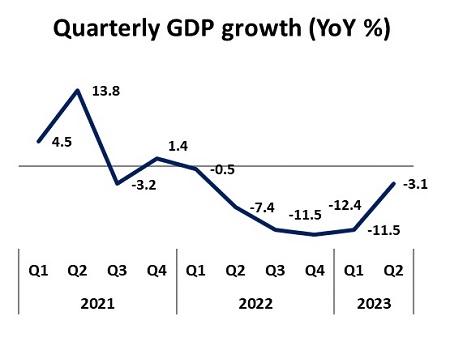

- The GDP recorded a decline of 7.9% (YoY) in the first half of 2023.

- In the event of a delay in the revival of apparel export orders, a lot will depend on earnings from tourism and remittances to provide support in relation to the external current account.

Economy: Performance in the second quarter

The year-on-year GDP growth rate for the second quarter (2Q) of 2023 has recorded a negative 3.1%. During this quarter, Agriculture activities have expanded by 3.6% while Industrial and Services activities have contracted by 11.5% and 0.8% respectively.

Among the ‘Industrial activities’, the ‘Construction’ and ‘Mining and quarrying’ activities have recorded negative growth rates of 23.1% and 24.3% respectively. The overall manufacturing industry contracted by 5.1% during 2Q. Most manufacturing activities have reported contractions in 2Q with respect to the corresponding quarter of 2022. ‘Manufacture of rubber and plastic products’ (26.5%), ‘Manufacture of textiles, wearing apparel, leather and other related products’ (18.4 %), ‘Manufacture of machinery and equipment’ (8.1%) and ‘Manufacture of basic metal and fabricated metal products’ (1.9%) are among the sectors that have reported declines during 2Q.

In relation to services activities, ‘Financial service activities’ has reported a significant downturn of 18.8% in 2Q. Further, ‘Professional services’ (9.3%), ‘IT programming consultancy and related activities’ (8.5%), and ‘Telecommunication’ (4.4%), have reported considerable negative growth rates during 2Q. Moreover, activities such as ‘Accommodation, food and beverage serving activities’ (34.2%), ‘Programming and broadcasting activities’ (6.2%), ‘Transportation of goods and passengers including warehousing’ (5.4%), are among the sectors that have reported positive growth rates during 2Q, 2023.

Debt restructuring leading to lower debt service payments.

Before Sri Lanka suspended its foreign debt repayments in April, 2022, it was projected that the country would have to repay USD 6 bn a year to its creditors until 2029. Post-debt restructuring, this sum will be significantly reduced to approximately USD 3 bn according to the Governor of the Central Bank of Sri Lanka (CBSL).

The current debt service payments, as a percentage of GDP, stand at 9.4%. However, post-debt restructuring, as per the IMF-program, Sri Lanka’s debt service payments will be a maximum of 4.5% of GDP.

The Governor of CBSL has expressed confidence that the government could fulfill its financing needs without opting for commercial borrowings, through revenue mobilization and lower level of debt servicing following the completion of the debt restructuring.

If the country outperforms the IMF targets, it may gain early access to commercial borrowings even before 2027. If the economy grows faster than expected, then there might be a need for commercial financing. However, if the Government manages its finances in such a way that it would not need to raise significant amounts of commercial financing going forward, that will help to maintain external debt sustainability (Governor, CBSL).

Sri Lankan economy: Outlook for the future

The GDP recorded a decline of 7.9% (YoY) in the first half of 2023. The economy is projected to rebound gradually from 2nd Half of, 2023, supported by the normalization of monetary conditions, improvements in business and investor sentiments, enhancements in supply conditions, relaxation of import restrictions, realization of improved foreign exchange inflows, the faster recovery of the tourism sector, and the implementation of growth promoting structural reforms. Achieving sustainable growth will depend to a great extent on the implementation of economic reforms.

One of the key achievements of the Central Bank has been its ability to get the rate of inflation under control by adopting a tight monetary policy. In order to keep interest rates under control, the rate of inflation will have to be kept in check. However, there are upside risks to inflation stemming from a possible increase in the prices of oil and other commodities, climate related risks and the possibility of greater than expected depreciation of the rupee in view of the ongoing relaxation of import restrictions.

The drop in interest rates (largely due to the drop in the rate of inflation) together with more stable macroeconomic conditions and the expected rebound in growth beginning from 2H, 2023 will provide a conducive environment for loan growth. Additionally, reduced interest rates will help to keep NPA levels in check.

On the external front, the drop in export earnings, in particular, the sharp drop in apparel export earnings, are key concerns for the Sri Lankan economy. A revival in apparel exports will depend on how soon apparel export orders can be revived. In the event of a delay in the revival of apparel export orders, a lot will depend on earnings from tourism and remittances to provide support in relation to the external current account.

Debt restructuring, as per the IMF-program, Sri Lanka’s debt service payments will be a maximum of 4.5% of GDP.

The Governor of CBSL has expressed confidence that the government could fulfill its financing needs without opting for commercial borrowings, through revenue mobilization and lower level of debt servicing following the completion of the debt restructuring.

If the country outperforms the IMF targets, it may gain early access to commercial borrowings even before 2027. If the economy grows faster than expected, then there might be a need for commercial financing. However, if the Government manages its finances in such a way that it would not need to raise significant amounts of commercial financing going forward, that will help to maintain external debt sustainability (Governor, CBSL).

Successful implementation of the IMF-EFF program and the Domestic Debt Optimization and External Debt Optimization plans will pave the way to upgrading Sri Lanka’s sovereign credit ratings, which in turn will help the country to gain access to commercial borrowings.

Interest Rates & Exchange Rate

At the T-bill auction held on 20th September, 2023 yields of 91 day t-bills decreased to 18.12% from 18.16% a week ago (-4bps) while yields of 182 day t-bills increased marginally to 15.38% from 15.19% a week ago (19bps). The 364 day t-bill yield dropped to 13.32% from 13.35% a week ago (-3bps). Meanwhile Rs 170bn worth bills were offered at the auction and the same were sold.

CBSL sold USD 170.5mn worth dollars to commercial banks on a net basis during August, 2023.

The Central Bank middle rate recorded Rs.324.40 per US dollar as of 21 September, 2023.

Global Outlook

- The Federal Reserve left the main U.S. interest rate unchanged on September 20 waiting to see if its historic series of rate hikes over the last 18 months gets inflation under control. The central bank kept its main policy rate in the range of 5.25% to 5.50%, citing an easing of economic conditions while also acknowledging that inflation is still higher than its 2% target.

- America’s annual rate of inflation jumped in August, to 3.7%, the second month in a row the rate has risen following a year of consistent declines. Most of August’s increase is explained by costlier petrol, the result of the decision by Saudi Arabia and Russia to cut oil output. Core rate of inflation, which strips out volatile food and energy prices, dropped in August to 4.3%.

- The European Central Bank raised its key interest rate to a record high of 4% on September 13 but, with the euro zone economy in the doldrums, signalled that the hike, its 10th in a 14-month-long fight against inflation, was likely to be its last. The central bank for the 20 countries that share the euro also raised its forecasts for inflation, which it now expects to come down more slowly towards its 2% target over the next two years, while cutting those for economic growth.

- The oil price is continuing its march towards USD 100 a barrel for the first time in almost a year, creating new inflationary headaches for central bankers. Brent crude, the international benchmark, has pushed over USD 95 per barrel, the highest since November 2022. Oil is being driven up by concerns of a supply deficit, following recent output cuts by Saudi Arabia and Russia, which have been extended until the end of this year.

- Argentina’s annual inflation rate rose to 124.4%, according to figures released by the government’s statistics agency on September 13. Experts say that those numbers will put the ruling centre-left coalition on the defensive, as the October 22 general election approaches.

Dr. Shanthikumar Fernando | Research & Development Unit | shanthikumar_fernando@combank.net

Disclaimer: This document has been issued for the information of the customers of Commercial Bank of Ceylon PLC only. The Bank and its employees do not accept any responsibility for the accuracy or completeness of the contents and any losses arising from any use of this material.

Commercial Bank ගේ පැතිකඩ බලන්න

SME අභිප්රෙරකයන්

Commercial Bank LEAP Team විසින් ලියන ලද අනෙකුත් ලිපි

Economic Overview: January 2024

සතියකට පෙර 45

Economic Overview: December 2023

සතියකට පෙර 50

මේ සතියේ වැඩිපුරම කියෙව්වේ

ප්රවණතා

අදහස්

කරුණාකර ඇතුල් වන්න හෝ ලියාපදිංචි කරන්න සාකච්ඡාවට එක්වීමට