Income Tax Return (ITR) Forms for AY 2021-22 issued

Tax & Auditing

190 week ago — 5 min read

The Central Board of Direct Taxation (CBDT) has announced a new update from the ITR Forms (ITR-1 to ITR-7) for the assessment year 2021-22. It was notified by the ministry of finance in a release on 1 April 2021. ‘In the view of the ongoing COVID-19 crisis and to promote the people paying tax, no important change has been done to the ITR forms with the last year’s ITR forms’, the CBDT said. Only the simple minimum changes required due to amendments in the Income Tax Act, 1961 have been made, the CBDT further added.

The taxpayers will now be given space in each of the ITR forms: Sahaj (ITR-1), ITR-2, ITR-3, ITR-4 (Sugam), ITR-5, ITR-6, ITR-7, and Form ITR-V to explain their investments, the CBDT said.

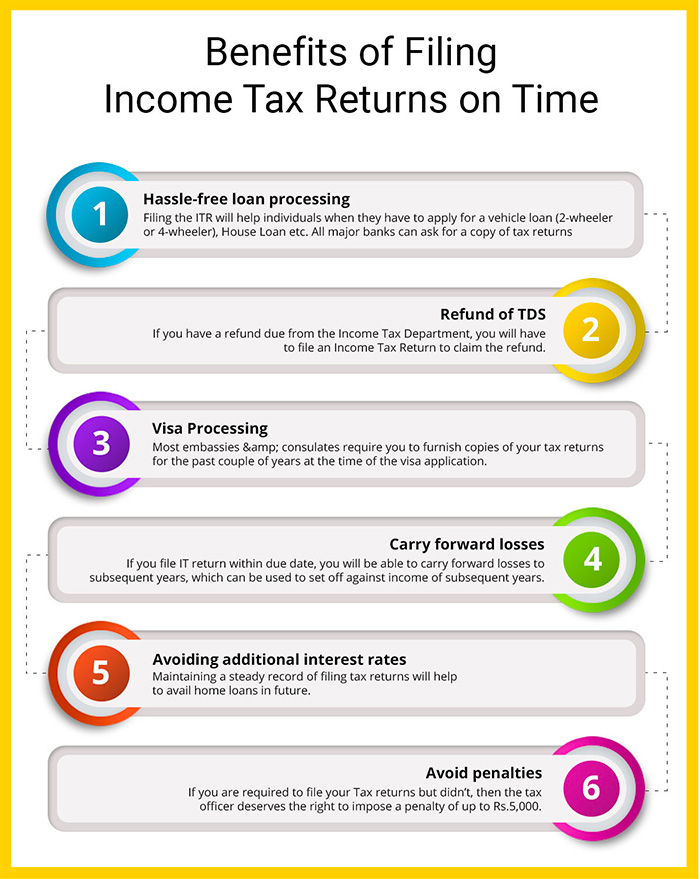

What are the benefits of filing Income Tax Returns on time?

Also read: Benefits of filing Income Tax Returns (ITR)

Who Can File ITR-1?

The ITR-1 (Sahaj) is for residents holding a total income of up to ₹50 lakh from their salaries. It could be single ownership, family pension income, interest income, etc.

Who Cannot File ITR-1 Sahaj?

Taxpayers whose salaries are more than ₹50 lakhs cannot fill out this form. Non-residents and RNOR (Residents Not Ordinarily Resident) are not eligible to file ITR-1. People with two or more residential properties are not eligible. Taxpayers possessing income under professional or business head are also not eligible to file ITR-1.

Who Can File ITR-4 Sugam?

ITR-4 Sugam is for HUFs, individuals, and firms (except limited liability partnerships) being residents with a total income of up to ₹50 lakh; having income from a business, one residential property (single ownership); and a profession which has a measure under sections 44AD, 44ADA, or 44AE, or income from interest, family allowance, etc. and agricultural or farm income up to ₹5,000.

Who Cannot File ITR-4 Sugam?

An individual owning residential property, income from salary, or other sources above ₹50 lakhs cannot utilise this form to file ITR. Moreover, an individual who is a director in a company and has invested in unlisted equity shares cannot use this form.

Who Can File ITR-2 and ITR-3?

HUFs (Hindu Undivided Families) and individuals not receiving an income from a trade or profession or business (and are not eligible for filing Sahaj ITR-1) can file ITR-2. Further, those having income from their profession or business can file ITR Form 3.

Who Can File ITR Form 5?

‘Persons other than a self-individual, HUF and firms i.e. partnership firm, Limited Liability Partnerships (LLP) etc. can file ITR Form 5. Moreover, companies or firms can file ITR Form 6. Political parties, trusts, charitable organisations etc. requiring exempt income under the Act can file ITR-7’, the report noted.

The notified ITR Forms are available on the official website. There is no difference in the manner of filing of ITR Forms as compared to last year, the tax body specified.

This year’s ITR forms do not have any significant variations. As we sorely need them to have because there need to be some possible changes so as to allow taxpayers to find it easy to comply with and report data consistently.

Besides the decision between the regimes, taxpayers need to report regularly on the dividend income received in FY 2020-21 in order to observe advance tax provisions related to how the advance tax is estimated and returned on capital gains.

Conclusion

This year (2021-2022) will be very important for all single taxpayers. This is the first time that taxpayers will have the opportunity to choose an additional beneficial tax regime.

To explore business opportunities, link with us by clicking on the 'Connect' button on our eBiz Card.

Image source: shutterstock.com

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Vakilsearch StaffGreetings! We would love to work with you and your company. We look forward to connecting with business houses and MSME's.

Network with SMEs mentioned in this article

View Vakilsearch 's profile

SME Inspirations

Most read this week

Trending

Comments (1)

Please login or Register to join the discussion